Obtain added information about SBA’s recent and earlier COVID-19 relief packages, which includes documents in other languages and debt aid for SBA loan borrowers impacted with the pandemic.

This application supplies little enterprises with funds to pay nearly 8 weeks of payroll charges including Advantages. Money can be accustomed to shell out fascination on home loans, lease, and utilities.

If you need enable addressing your loan servicer, want extra information about different ways to avoid foreclosure, or are looking for information about how you can fight a foreclosure, take into consideration speaking to a foreclosure lawyer. Conversing with a (cost-free) HUD-permitted housing counselor is likewise a good suggestion.

The most common secured loans are mortgages and vehicle loans. In these illustrations, the lender holds the deed or title, which is a illustration of ownership, until finally the secured loan is totally compensated. Defaulting over a house loan generally results in the lender foreclosing on a home, though not spending a vehicle loan means that the lender can repossess the vehicle.

Following a borrower difficulties a bond, its price will fluctuate determined by interest prices, marketplace forces, and many other elements. Whilst this doesn't alter the bond's worth at maturity, a bond's market price can nevertheless range through its lifetime.

It is possible to Focus on increasing your credit history rating before implementing to get a loan by having to pay off delinquencies and debts. Should your historical past remains to be a problem, question a guardian or maybe a relative with superior credit score to cosign on a loan. Doing this usually means a major obligation on their own portion given that they're equally liable for the loan if you don't make the payments, so talk to properly.

Firms in specified industries could have a lot more than 500 workers if they fulfill the SBA’s dimensions expectations for all those industries.

That you are responsible for your COVID-19 EIDL month-to-month payment obligation beginning thirty months from the disbursement day demonstrated on the highest with the entrance webpage of the Unique Notice. In the course of this deferment:

Normally, the for a longer time the phrase, the greater curiosity will likely be accrued with time, raising the full price of the loan for borrowers, but cutting down the periodic payments.

Quite a few purchaser loans tumble into this group of loans that have standard payments which might be amortized uniformly about their life span. Plan payments are created on principal and fascination right up until the loan reaches maturity (is totally paid out off). A few of the most familiar amortized loans involve home loans, motor vehicle loans, university student loans, and private loans.

Learn from the start how much You will be paying out back again more than the lifetime of the loan and Test the curiosity check here price on present. Obtaining a reduce rate usually means spending back much less revenue. Ensure that you search presentable and businesslike whenever you utilize. Initially impressions count.

Credit history matters massive time In terms of acquiring a loan as well as your earlier payment background plays a big portion in calculating your credit rating. In the event you haven’t designed Significantly of the credit history background, a lender will probably cost the next interest charge and gained’t lend you just as much money.

Find out more → Qualifying for a lender loan is usually tough when you’re 19 many years previous and haven’t set up an extensive function or credit record.

Lawful Update: As of April thirty, 2023, mortgage loan servicers will have to Appraise all eligible borrowers with FHA-insured home loans who are in default or going through imminent default utilizing the COVID-19 loss mitigation waterfall method, whatever the reason behind the borrowers' economical issues.

SBA delivers cost-free or minimal-Expense counseling for tiny companies via its national community of Source Partners. These husband or wife corporations might be able to assist review your organization system, discover options to access funds, or supply info on applicable tax Gains, between other counseling providers.

Increase your chances of obtaining accepted by opening a credit score-card account and having to pay the balance in full each month. If you're able to swing a little auto loan to begin, creating loan payments on time for 2 several years can Improve your credit score rating.

Though banks normally received’t use a discounts account as collateral, some accept a certificate of deposit to safe a loan. If you're borrowing income to buy a vehicle, the financial institution can utilize the vehicle as collateral and repossess it in case you default.

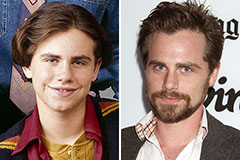

Rider Strong Then & Now!

Rider Strong Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now!